The Dawson PPD Board of Directors set some key goals for 2021 and beyond, including the establishment of a Rate Stabilization Fund. The purpose of the fund is to help the District keep rates steady by setting funds aside to fill in the gaps when necessary, similar to a personal emergency savings fund.

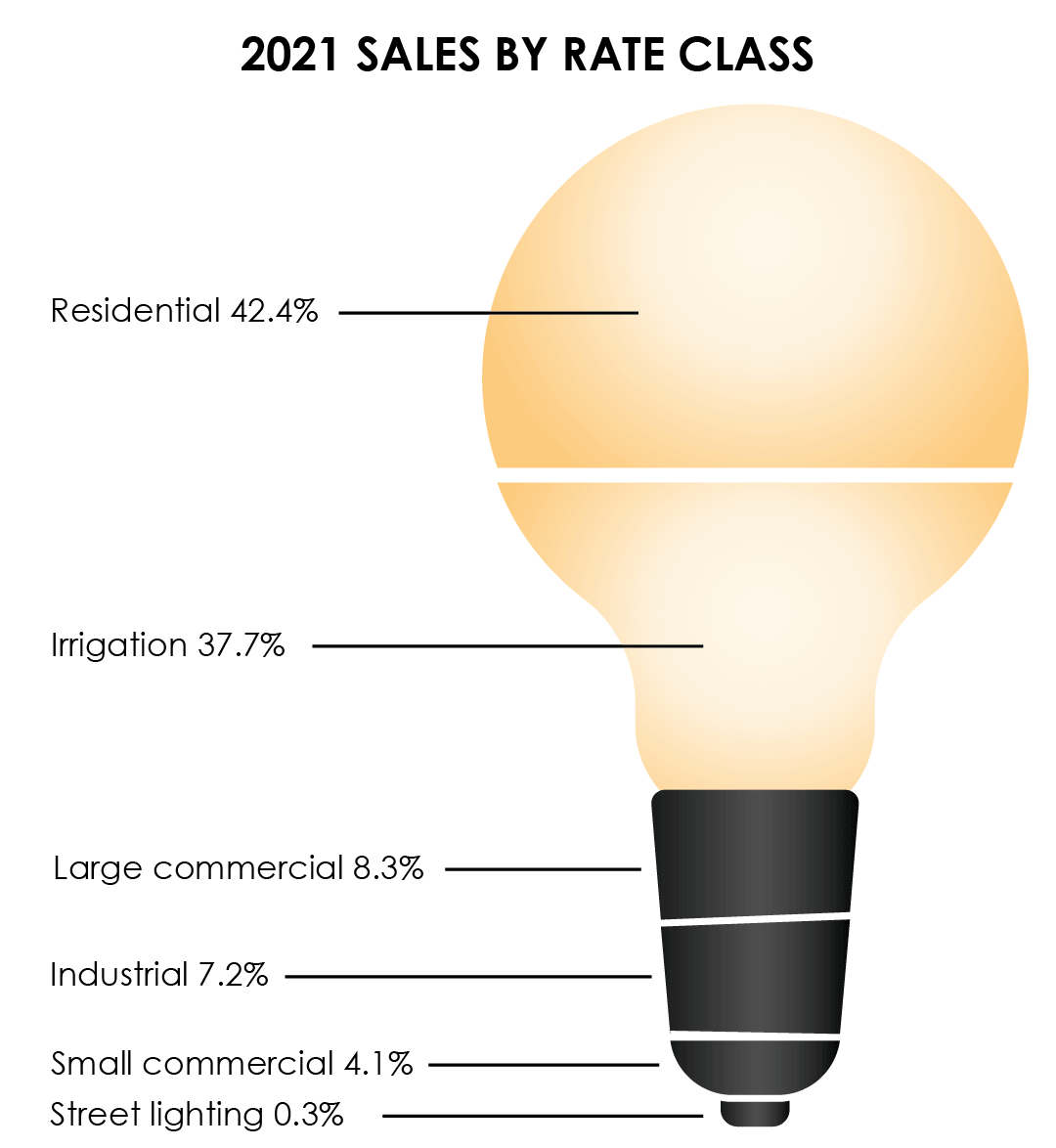

The two main sources of revenue for Dawson PPD are residential and irrigation customers. Both of these groups use electricity in reaction to the weather. When summers have plentiful rainfall and cooler temperatures, both pivots and air conditiong units are used less. However, when summers are hot and dry, pivots tend to pump more water and air conditioners are set to full blast.

No matter how much energy each group uses, there are fixed costs to running and maintaining Dawson PPD’s electrical system. The Rate Stabilization Fund will be deposited into or withdrawn from accordingly to help balance the surplus years of revenue from insufficient years.

Other contributing factors

- Irrigation sales were up by four percent

- Staying under budget by 11.4 percent

- 199 new electrical services

- Reduced labor cost by six dollars per meter at $334 annually.

Why?

Reinvestment in Dawson PPD’s electrical grid and more in-house line construction projects contributed to the reduced costs.

$4.83

Average residential cost of electricity per day

1,297 kWh

Average monthly electrical usage for General Service

3.98

Customers per mile of power lines

Lease and franchise payments reach about $400,000

Dawson PPD presented lease and franchise payments totaling about $400,000 to area communities served by the District.

A leased town owns their electric utility system including the poles, wires, transformers and meters. Dawson PPD collects a lease payment as set by the town on each monthly electric bill. This appears as a line item on customers’ bills titled “village-imposed lease payment adjustment.” Then, the payment is remitted back to the community on a schedule set by community leaders.

Hershey collects a franchise tax from its citizens. It is treated similarly to a lease payment. Dawson PPD pays the franchise tax back to Hershey once a year.

In addition, Dawson PPD adds gross revenue, or receipts, tax as mandated by state statute.

According to the 1960 statute, the gross receipts tax mandates that all public power districts pay each community’s county treasurer five percent of the gross revenue derived from these leased towns. This means that Dawson PPD adds another five percent tax to the leased town customer’s monthly electric bill and pays each community’s respective county annually. The county treasurer disperses the money.

Each item is listed on the leased town customer’s bill so they can see exactly what and how much the charges are.

2021 Dawson PPD Lease Payments

| Brady | $43,714.21 |

| Elwood | $97,232.44 |

| Eustis | $59,940.89 |

| Miller | $15,517.33 |

| Overton | $89,849.36 |

| Amherst | $22,302.70 |

| Pleasanton | $41,531.36 |

| TOTAL | $370,088.39 |

2021 Dawson PPD Franchise Payments

| Hershey | $19,435.18 |

| GRAND TOTAL | $389,523.57 |

2021 Dawson PPD Gross Receipts Tax*

| Eustis | $30,110.93 |

| Smithfield | $2,780.33 |

| Elwood | $38,989.70 |

| Farnam | $12,437.19 |

| Sumner | $15,251.36 |

| Eddyville | $4,317.56 |

| Overton | $43,976.76 |

| Hershey | $38,558.43 |

| Maxwell | $13,868.21 |

| Brady | $22,092.82 |

| Miller | $7,697.94 |

| Riverdale | $10,631.34 |

| Ravenna | $240,281.74 |

| Amherst | $14,814.72 |

| Pleasanton | $22,547.84 |

| TOTAL | $518,356.87 |

*The Gross Receipts Tax and the In Lieu of Tax are remitted to the county treasurer for distribution.

2021 Dawson PPD In Lieu of Tax*

| Buffalo County | $604.20 |

| Gosper County | $243.68 |

| Dawson County | $5,106.40 |

| Frontier County | $292.46 |

| Lincoln County | $1,157.04 |

| Hall County | $15.70 |

| Sherman County | $33.51 |

| TOTAL | $7,452.99 |

*The Gross Receipts Tax and the In Lieu of Tax are remitted to the county treasurer for distribution.

OTHER NEWS

Need help with bills?

The U.S. Department of Energy’s Weatherization Assistance Program installs energy efficiency measures in the homes of qualifying homeowners free of charge. The Community Action Partnership of Mid-Nebraska administers these funds. The mission of WAP is to reduce energy...

Public office candidate training school

Get the information you need for an effective and winning campaign when you attend the NREA Candidate Training School held in Lexington on November 19, 2021. Whether you're interested in a local election or a state election, this class will help you learn more about...

Clean diesel rebates available now through January 13, 2022

Nebraskans looking to upgrade their diesel irrigation engines to electric motors may receive a rebate through the Nebraska Department of Environment and Energy. The application period is October 1, 2021, through January 13, 2022. The NDEE's Clean Diesel Rebate Program...